Non Current Liabilities Examples

Theyre also called long-term. Non Current Liabilities Examples.

Non Current Liabilities Definition Meaning Types Lists Example

The portion of a.

. Non-current liabilities definition Non-current liabilities are the debts a business owes but isnt due to pay for at least 12 months. Liabilities Assets Equity. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

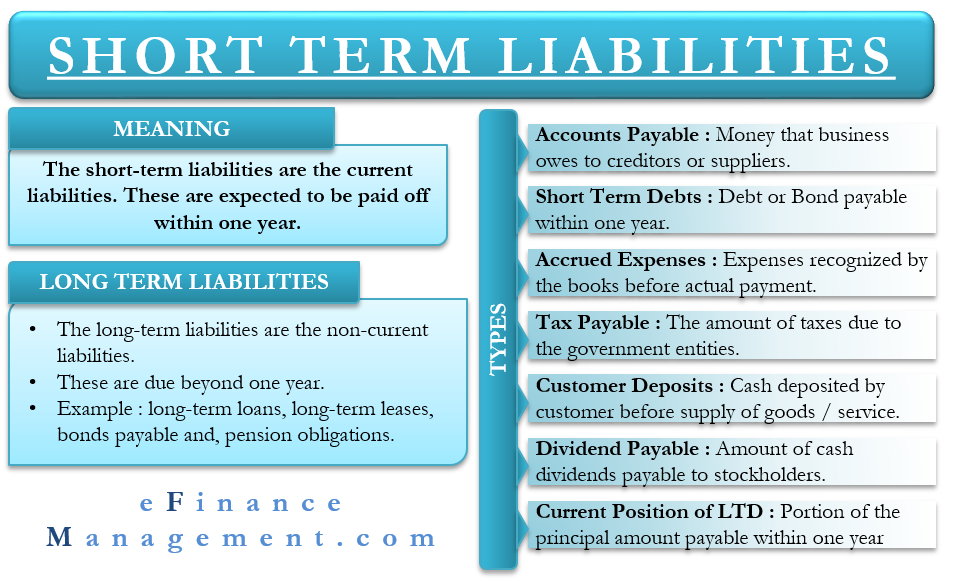

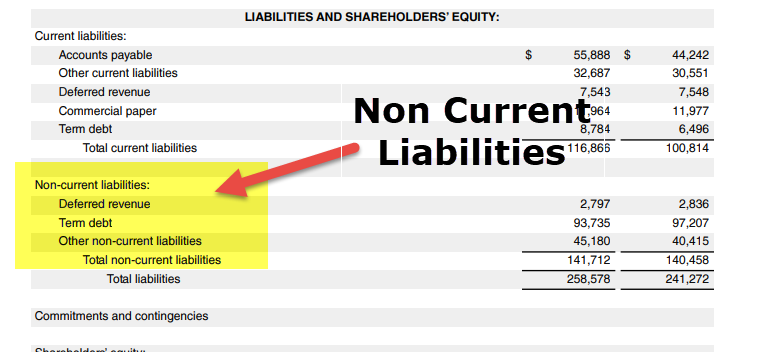

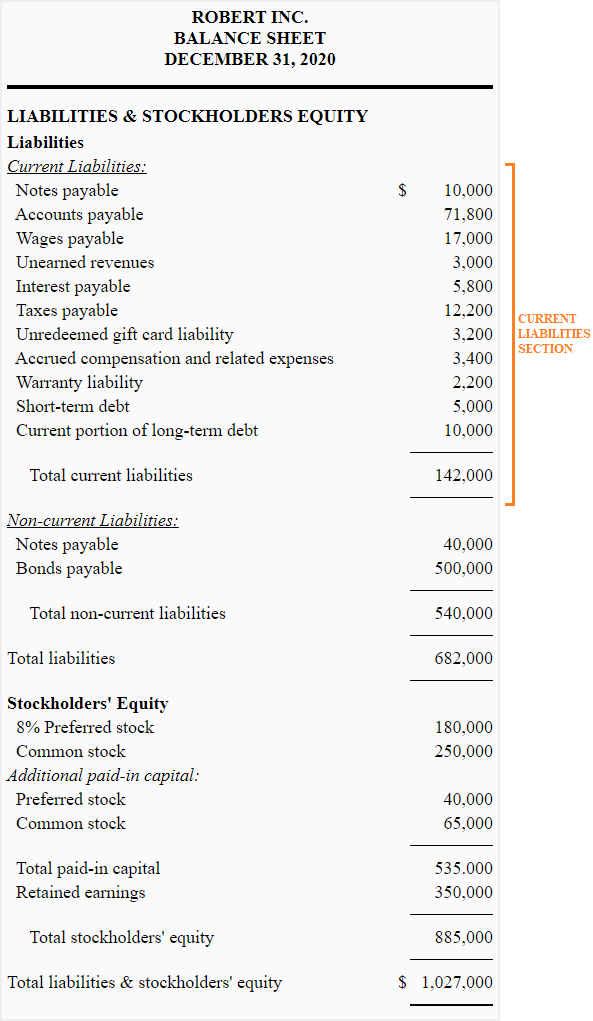

Noncurrent liabilities include debentures long-term loans bonds payable deferred tax liabilities long-term lease obligations and pension benefit obligations. Some common non-current liabilities examples include bank loans bonds payable long-term leases. Typical examples could include everything from pension benefits to long-term.

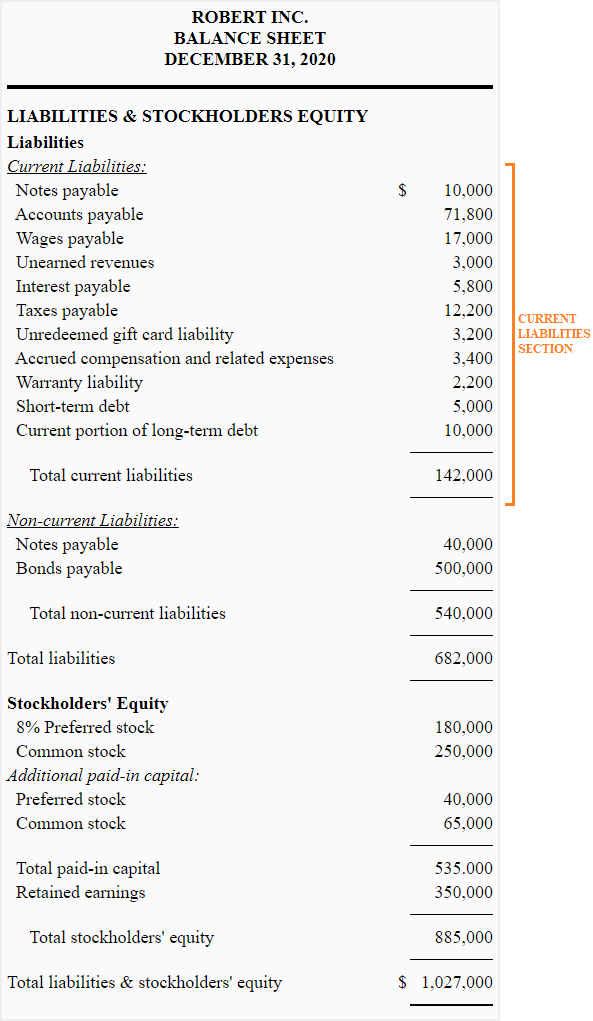

The non-current liabilities definition refers to any debts or other financial obligations that can be paid after a year. By contrast current liabilities are defined as financial obligations due within the next twelve months. Noncurrent liabilities are long-term financial obligations listed on a companys balance sheet that are not due within the present accounting year such as long-term.

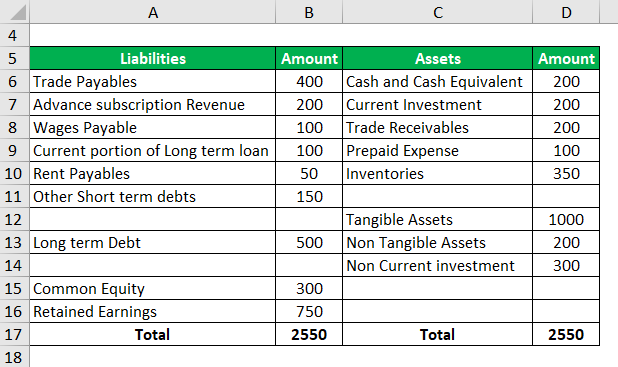

Non-current liabilities can include. An example of the current portion of long-term debt is the term loan taken by the company amounting to 6000 but from that 6000 1000 is repayable within one year of the reporting. Pension benefits long-term property rentals and deferred tax.

This represents a contract where a. Examples of Noncurrent Liabilities Noncurrent liabilities include debentures long-term loans bonds payable deferred tax liabilities long-term lease obligations and pension benefit. Non-current liabilities are defined as any debts or other financial commitments that are repayable after a year.

Long-term loans long-term leasing debentures bonds payable deferred tax liabilities obligations and pension benefit payments are examples of. In the balance sheet assets records at the first class and total assets in the balance sheet show. Theyre also called long-term liabilities.

There are many different types of non-current liabilities for companies. Ad Get Access to the Largest Online Library of Legal Forms for Any State. The most common examples of non-current liabilities include the following.

How To Use Long-Term Liabilities With Examples Types of non-current liabilities. Therefore to calculated liabilities we can turn as follow. It is also known as long-term liabilities or long-term debt.

Up to 8 cash back Non-current liabilities definition Non-current liabilities are the debts a business owes but isnt due to pay for at least 12 months. A negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Non-current liabilities are types of liabilities that a business is going to pay after the maturity period of more than 12 months.

Examples of Non-Current Liabilities.

Short Term Liabilities I Meaning And Types Efinancemanagement

Current Liabilities Formula How To Calculate Current Liabilities

Current Portion Of Long Term Debt Double Entry Bookkeeping

Balance Sheet Items List Of Top 15 Balance Sheet Items

Non Current Liabilities Definition And Balance Sheet Examples

What Are Current Liabilities Definition Explanation Examples Journal Entries Presentation Accounting For Management

Comments

Post a Comment